Important Coverage Information

This article provides general educational information about Medicare coverage for memory care based on current federal guidelines. Coverage rules vary by individual Medicare plan and by state, and regulations change periodically. For decisions related to coverage or eligibility, confirm current benefits directly with Medicare at Medicare.gov or by calling 1-800-MEDICARE.

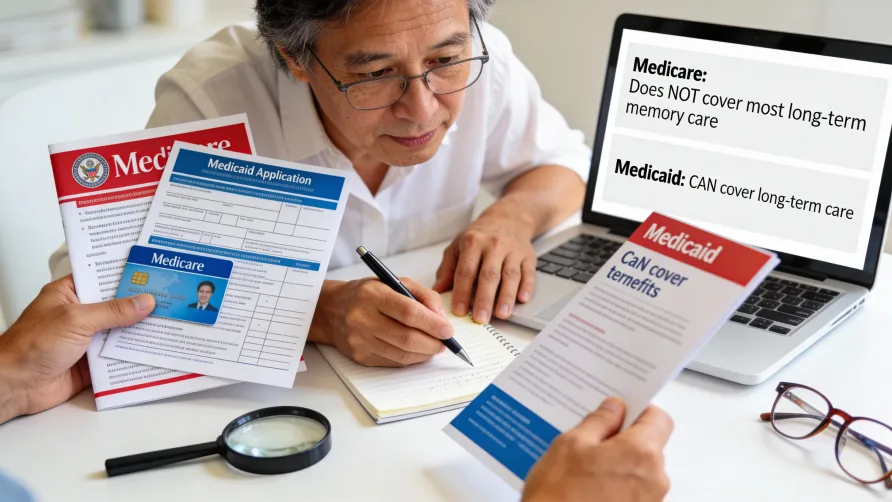

Understanding Medicare and Memory Care Coverage

You've heard Medicare covers nursing care, so why won't they pay for memory care? This question catches many families off guard when they're researching care options for a parent with dementia. The confusion is understandable. Medicare does cover certain types of nursing care, and your parent's memory care needs feel just as urgent and medically necessary as any other health condition.

The short answer is that Medicare typically does not cover long-term residential memory care costs. However, Medicare may cover some services related to dementia care, and understanding exactly what's covered versus what isn't, can help you plan more effectively. This guide breaks down Medicare coverage for memory care in straightforward terms, explains the difference between Medicare and Medicaid, and points you toward resources that can help bridge the coverage gap.

What Medicare DOESN'T Cover for Memory Care

Medicare generally does not pay for long-term residential memory care facilities. This includes the monthly cost of living in a dedicated memory care community, assisted living memory care unit, or similar residential setting designed for people with dementia.

The reason comes down to how Medicare defines medically necessary care. Medicare is structured to cover acute medical needs and skilled services that require professional healthcare providers. Long-term memory care, in Medicare's classification, falls under "custodial care" or "long-term care," which includes assistance with activities of daily living like bathing, dressing, eating, and supervision to keep someone safe.

What custodial care includes. Memory care facilities typically provide 24-hour supervision, assistance with daily activities, specialized programming for cognitive impairment, and secure environments to prevent wandering. While these services are essential for someone with dementia, Medicare considers them non-medical support services rather than skilled medical treatment. This means Medicare won't pay for room and board at a memory care facility, nor will it cover the monthly fees for living there.

Why does this matter financially. Memory care costs can range from roughly $4,500 to over $8,000 per month depending on location and level of care, as of 2025. These costs typically include housing, meals, personal care assistance, and specialized programming. Since Medicare doesn't cover these expenses, families generally need to plan for private payment through savings, long-term care insurance, veterans benefits, or other resources.

Medicare Supplement (Medigap) policies don't fill this gap either. You might assume that a Medigap policy would help with memory care costs, but these supplemental insurance plans are designed to cover Medicare deductibles, copayments, and coinsurance. They follow Medicare's rules about what's covered in the first place. If Medicare doesn't cover long-term memory care, neither will a Medigap plan.

Medicare Advantage plans typically follow the same rules. Most Medicare Advantage plans (Part C) must provide at least the same coverage as Original Medicare, which means they generally don't cover long-term residential memory care either. Some Medicare Advantage plans may offer additional benefits or care coordination services for people with dementia, but these extras typically don't extend to paying for memory care facility costs.

The assisted living and memory care distinction. Medicare treats memory care facilities the same way it treats assisted living communities when it comes to coverage. Whether a facility markets itself as assisted living, memory care, or a dementia care unit, Medicare's position remains consistent: if the primary need is for supervision and help with daily activities rather than skilled nursing services, Medicare typically won't cover the residential costs.

This can feel frustrating when your parent clearly needs specialized care due to a medical diagnosis. The reality is that Medicare was designed primarily as health insurance for acute and skilled care needs, not as long-term care insurance. Understanding this distinction helps you focus your planning on resources that actually can help pay for memory care.

What Medicare Does Cover for Memory Care

While Medicare doesn't pay for long-term residential memory care, it does cover certain medical services that people with dementia may need, even if they're living in a memory care facility.

Medicare Part B generally covers cognitive assessments and care planning. Since 2011, Medicare has included cognitive impairment screening as part of the annual wellness visit. If your parent shows signs of memory problems, their doctor can conduct assessments and develop a care plan. Medicare Part B typically covers these services without requiring the Part B deductible, as of 2025 guidelines.

Medical treatment for dementia is generally covered. Medicare Part B covers doctor visits, outpatient services, medical equipment, and diagnostic tests related to dementia and Alzheimer's disease. This includes visits with specialists, brain imaging when medically necessary, and other diagnostic procedures. If your parent lives in a memory care facility and needs to see a doctor or get medical treatment, Medicare typically continues to cover these services just as it would if they lived at home.

Prescription medications may be covered under Part D. Many people with dementia take medications to help manage symptoms. Medicare Part D prescription drug plans typically cover medications commonly prescribed for Alzheimer's disease and related dementias, though coverage and costs vary by plan. You'll want to review your parent's Part D plan annually to confirm their specific medications remain covered.

Where This Gets Confusing: Skilled Nursing vs. Memory Care

Here's where many families get tripped up. Medicare Part A does cover care in a skilled nursing facility, but this coverage has very specific requirements that most memory care situations don't meet.

Medicare may pay for up to 100 days in a skilled nursing facility, but only following a qualifying three-day inpatient hospital stay. Your parent must need daily skilled nursing care or skilled rehabilitation services that can be provided only by healthcare professionals like registered nurses or physical therapists. The care must be for the same condition that required hospitalization, and it must be deemed medically necessary.

In 2025, Medicare Part A typically covers the full cost for the first 20 days in a qualified skilled nursing facility. From day 21 through day 100, beneficiaries generally pay a daily coinsurance of $209.50 per day. After 100 days, Medicare coverage ends entirely for that benefit period.

The key distinction: this skilled nursing coverage is for short-term rehabilitation or treatment following a medical event like a stroke, fall, or surgery. It's not designed for long-term custodial care, even when that care is needed because of dementia. Once your parent no longer requires skilled services and needs only assistance with daily activities, Medicare coverage typically ends even if they haven't reached the 100-day limit.

Medicaid vs. Medicare for Memory Care

Medicaid functions differently from Medicare when it comes to memory care coverage, though understanding the specifics can be complex because Medicaid programs are administered by individual states.

Nursing home coverage through Medicaid. For eligible individuals, Medicaid typically covers nursing home care including room and board costs. This represents a significant difference from Medicare. If your parent qualifies for Medicaid and needs nursing home level care, Medicaid may pay for all or most of the costs at a Medicaid-certified facility. In 2025, nursing home costs often exceed $7,000 to $9,000 per month, making Medicaid coverage substantial when available.

However, not all nursing homes accept Medicaid, and some facilities have limited Medicaid beds. Additionally, qualifying for Medicaid requires meeting both medical necessity criteria and financial eligibility requirements, which vary by state. Generally, applicants must have limited income and assets, with specific thresholds determined by each state's program.

Home and Community-Based Services waivers. Many states offer Medicaid waiver programs (often called HCBS waivers) that can help pay for care in settings other than nursing homes, including some assisted living or memory care facilities. These waivers typically cover services like personal care, medication management, and specialized memory care programming, but they generally don't cover room and board expenses.

Waiver programs differ significantly from state to state in terms of availability, services covered, and eligibility requirements. Unlike regular Medicaid nursing home benefits, which are entitlement programs, most waiver programs have enrollment caps and waiting lists. This means even if your parent qualifies, they might need to wait for an opening in the program.

The dual eligible scenario. Some individuals qualify for both Medicare and Medicaid. In these cases, Medicare typically serves as the primary insurance for medical services, while Medicaid may help cover long-term care costs that Medicare doesn't pay for. Approximately 12 million Americans are dually eligible for both programs, as of recent estimates.

Why Medicaid planning matters. Because Medicaid has strict financial requirements and the rules vary by state, many families work with elder law attorneys to understand their options. Medicaid has look-back periods and rules about asset transfers that can affect eligibility, so it's generally important to explore this option well before care is needed.

For specific information about Medicaid coverage for memory care in your state, contact your State Medicaid Agency. The rules governing what's covered, where care can be provided, and what it costs can differ substantially depending on where your parent lives.

Does Medicare Advantage Cover Memory Care Differently?

Medicare Advantage plans (Part C) are required to cover at least what Original Medicare covers, which means they generally don't pay for long-term residential memory care either. However, some Medicare Advantage plans may offer additional benefits that could help with dementia-related care.

Certain Medicare Advantage plans include care coordination services, telehealth options, or limited in-home support services that aren't available through Original Medicare. Some plans designed as Special Needs Plans specifically for people with chronic conditions like dementia may offer enhanced benefits, though availability is limited. As of 2024, only a few states had Medicare Advantage Special Needs Plans specifically for dementia.

If your parent has a Medicare Advantage plan, contact the plan directly to ask about any additional benefits that might apply to dementia care. Coverage details, costs, and network restrictions vary significantly between plans and can change annually.

Are There Medicare Programs That Cover More?

Medicare has introduced some programs aimed at improving dementia care, though they don't typically cover long-term residential costs.

The GUIDE model (Guiding an Improved Dementia Experience) is a newer Medicare initiative that some beneficiaries may be able to access. This program provides care coordination and support services for people with dementia and their caregivers, including respite care services. However, participation is limited to beneficiaries whose healthcare providers participate in the program.

Medicare also covers hospice care for people with dementia who are determined by a doctor to have six months or less to live. Hospice services under Medicare Part A can be provided in various settings, including nursing homes and memory care facilities, though Medicare typically doesn't pay for room and board in these settings even under hospice.

What About Home Healthcare for Dementia?

Medicare Part A and Part B may cover limited home healthcare services for people with dementia, but only under specific circumstances. Your parent must be homebound, meaning they have difficulty leaving home without assistance. They must need skilled nursing care or therapy services like physical, occupational, or speech therapy on a part-time or intermittent basis. A doctor must order the home healthcare and certify that it's medically necessary.

Home health aide services for help with bathing, dressing, and other daily activities may be covered, but only if your parent is also receiving skilled care at the same time. Medicare generally doesn't cover home care that consists only of assistance with activities of daily living without concurrent skilled services.

For families hoping Medicare might cover in-home memory care support, this limitation can be disappointing. The reality is that most of what people need for dementia care at home falls outside Medicare's skilled care requirements.

How Can You Pay for Memory Care If Medicare Doesn't Cover It?

Since Medicare typically doesn't cover long-term memory care costs, families generally need to explore alternative funding sources.

Private payment through savings, retirement income, or selling assets remains the most common way people initially pay for memory care. Long-term care insurance policies may cover some or all of memory care costs, depending on the specific policy terms. Veterans and surviving spouses may qualify for Aid and Attendance benefits through the VA, which can provide additional monthly income to help with care costs.

Medicaid, as discussed earlier, may eventually help cover costs for those who qualify financially. Some families plan to private pay initially and then transition to Medicaid coverage once their savings are spent down, though this requires careful planning due to Medicaid's look-back period and eligibility rules.

For personalized guidance on paying for memory care, consider consulting with a financial advisor or elder law attorney who specializes in long-term care planning.

Where to Get Current Coverage Information

Medicare rules can change, and individual circumstances affect coverage decisions. For the most current information about your parent's specific Medicare coverage:

Call Medicare at 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

Visit Medicare.gov to access personalized information after creating or logging into a secure Medicare account.

Contact your parent's Medicare Advantage plan directly if they have Part C coverage.

For questions about Medicaid coverage, reach out to your State Medicaid Agency. Contact information can be found at Medicaid.gov.

The Bottom Line

Medicare generally doesn't cover long-term residential memory care, which creates a significant gap for families managing dementia care costs. While Medicare does pay for certain medical services related to dementia, including diagnostic testing, doctor visits, medications, and limited skilled nursing care following hospitalization, the monthly cost of living in a memory care facility typically falls outside Medicare coverage.

Understanding what Medicare covers and what it doesn't lets you plan more realistically. For many families, a combination of resources ends up funding memory care: private savings initially, possibly long-term care insurance, veterans benefits if applicable, and eventually Medicaid for those who qualify. The earlier you explore these options, the more choices you'll have.